A Contradictory Economic Picture

Many people feel that finding jobs in the UK is becoming increasingly difficult. But surprisingly, the data shows that employee salaries keep rising. This contrast is creating a growing gap between the old and new workplace realities.

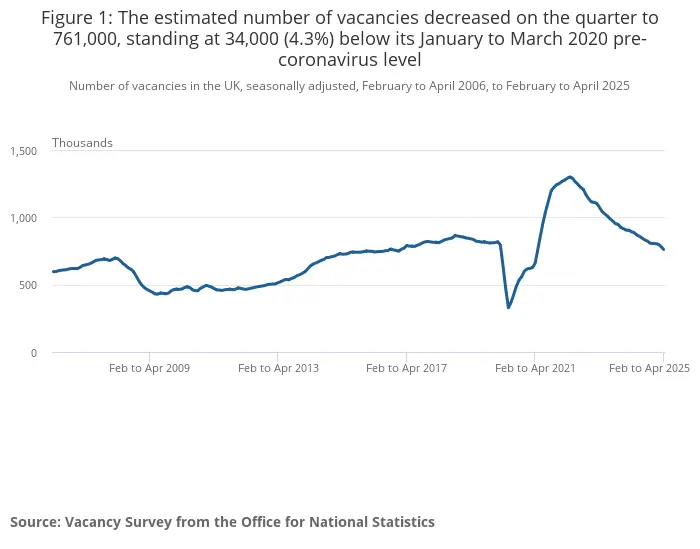

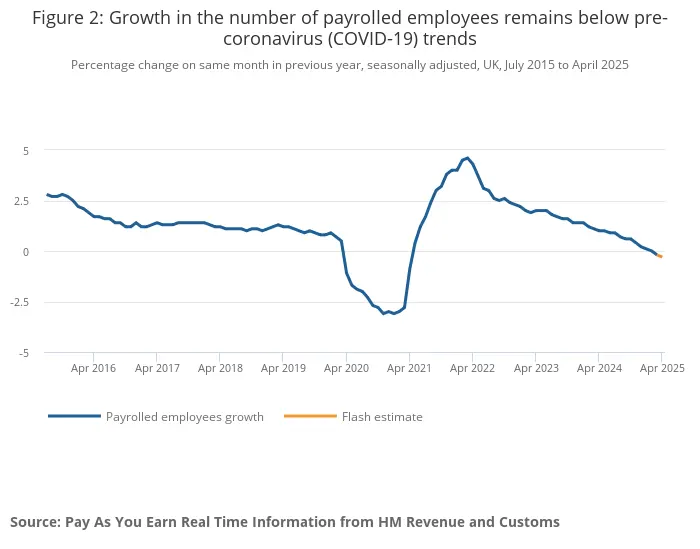

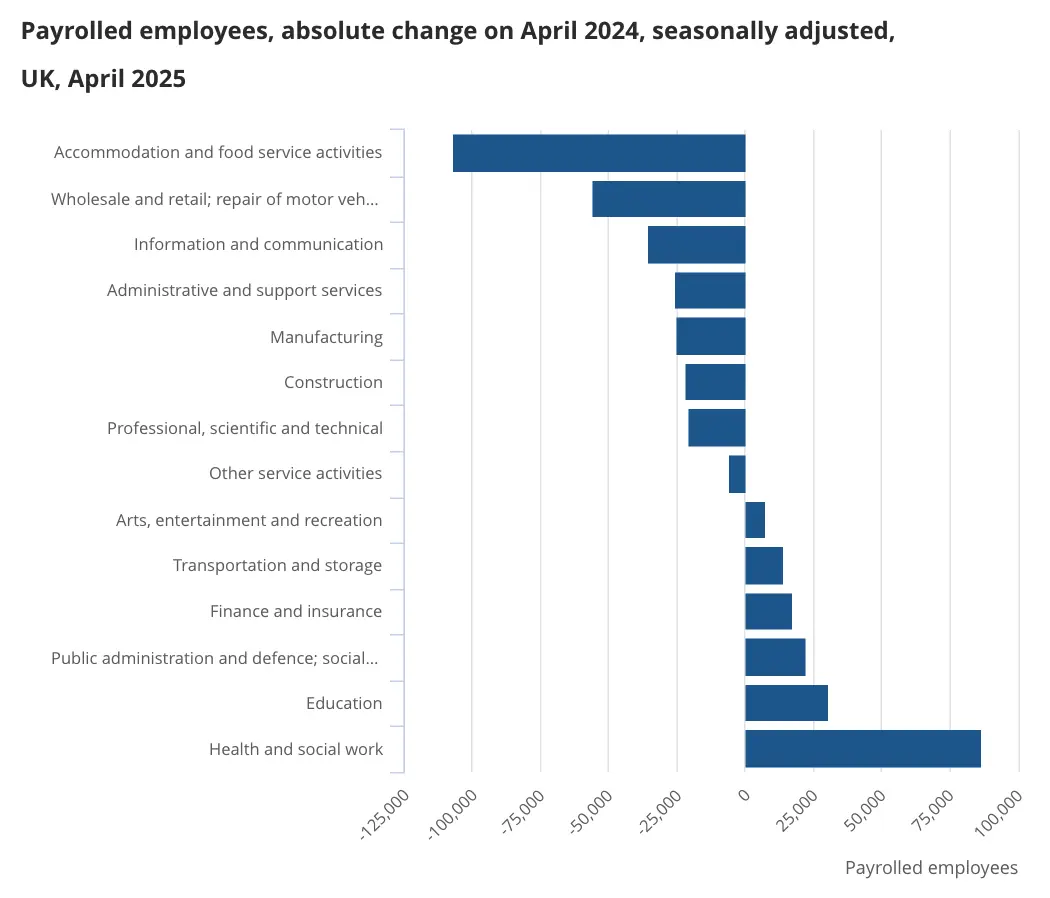

According to the Office for National Statistics (ONS), just in the past year, the UK has lost over 100,000 job opportunities. Looking at the trend since May 2022, overall vacancies have been declining steadily, now down 4.3% compared to pre-pandemic levels, roughly 34,000 fewer positions. The total number of employees isn’t looking great either, slowly dropping since 2023 and almost hitting negative growth.

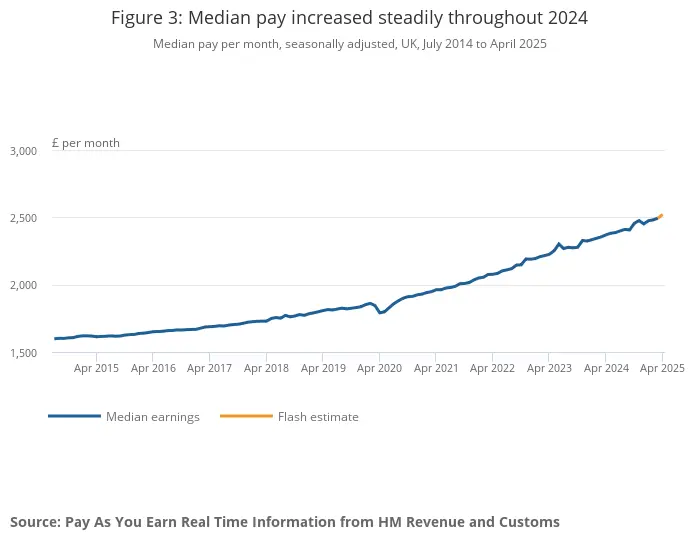

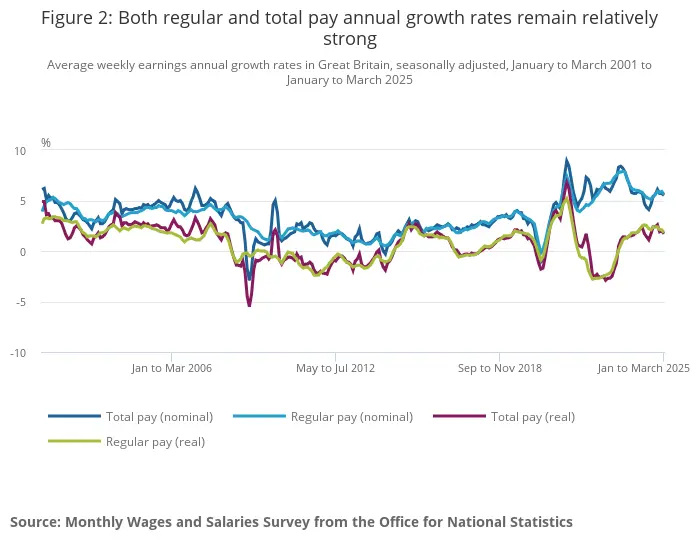

But on the flip side, wages are actually going up, not down. Since March 2021, the annual growth rate of median wages has stayed consistently above 5%. Even with high inflation, real wages started stabilizing from late 2022, and by April 2023 they turned positive, now back to early 2022 levels with real increases of about 1% to 2.5%.

Who’s Getting the Biggest Raises?

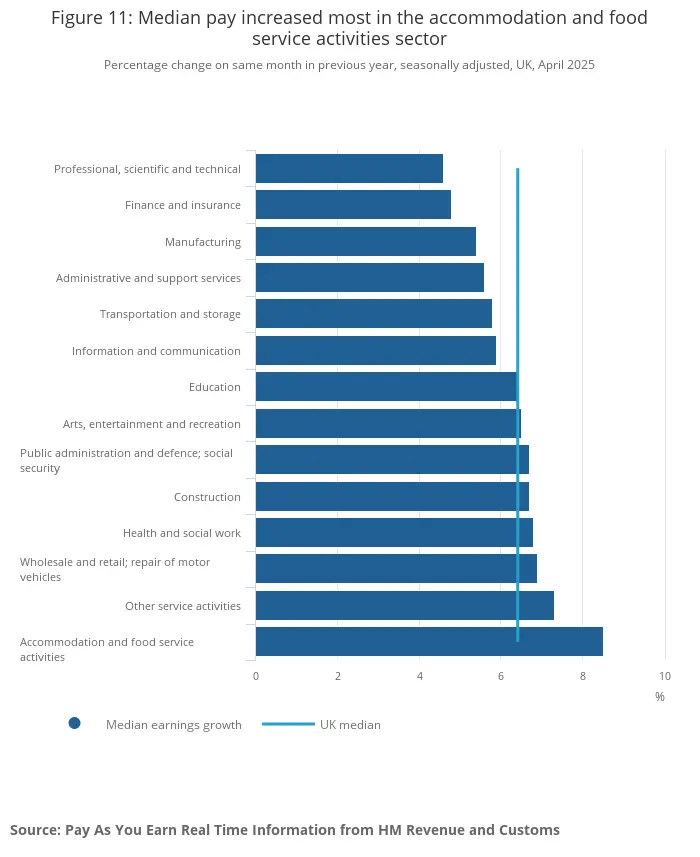

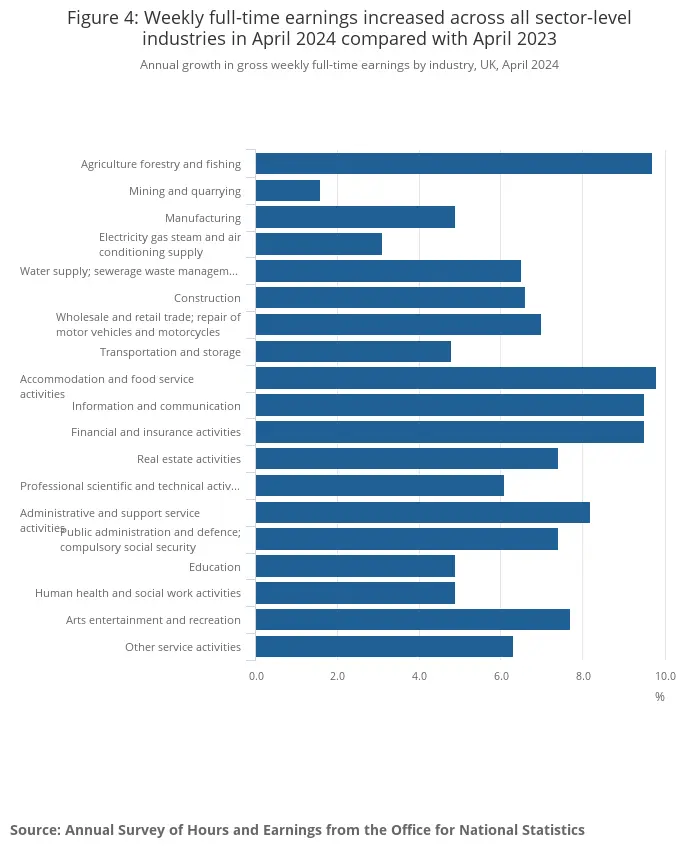

Looking deeper into wage changes across different industries, as of this April, accommodation and food services had the highest wage growth, with retail also above the overall median. In contrast, research, finance & insurance, and information & communication positions had lower increases. However, if we rewind to April last year, finance, insurance, and information & communication were actually leading the pack, matching accommodation and food services with all three exceeding 8%. This shows how much wage performance has fluctuated in these sectors that traditionally attract international white-collar talent over the past two years.

Possible Reasons

Why is this “fewer jobs but higher wages” phenomenon happening? Several explanations are being discussed.

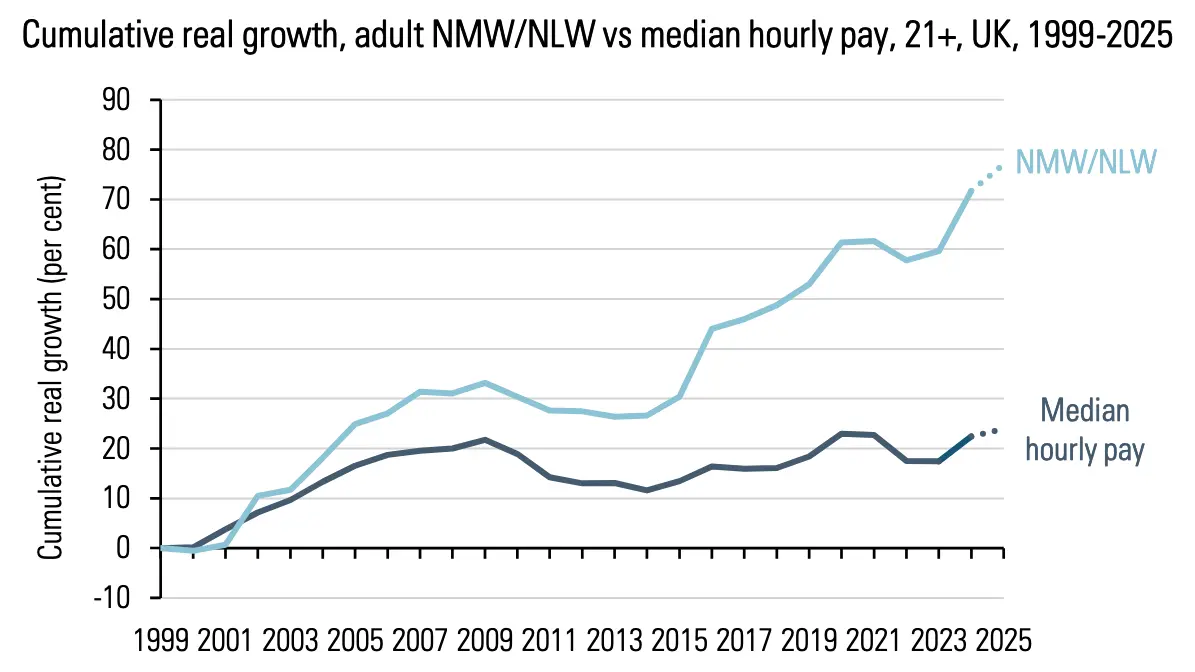

The Financial Times points out that minimum wages have increased significantly in recent years, plus high-earner growth has been faster than low-earner growth, pulling up the overall average wage. Economist Greg Thwaites thinks that many unemployed people aren’t actively looking for work, so job seekers can hold onto their salary expectations without having to settle. Plus, in an environment of continuously rising prices, workers are more likely to seek high-paying jobs that can fight inflation. Additionally, if companies improve productivity, they also have more room to offer good salaries and retain talent.

Where Did the Extra Money Go?

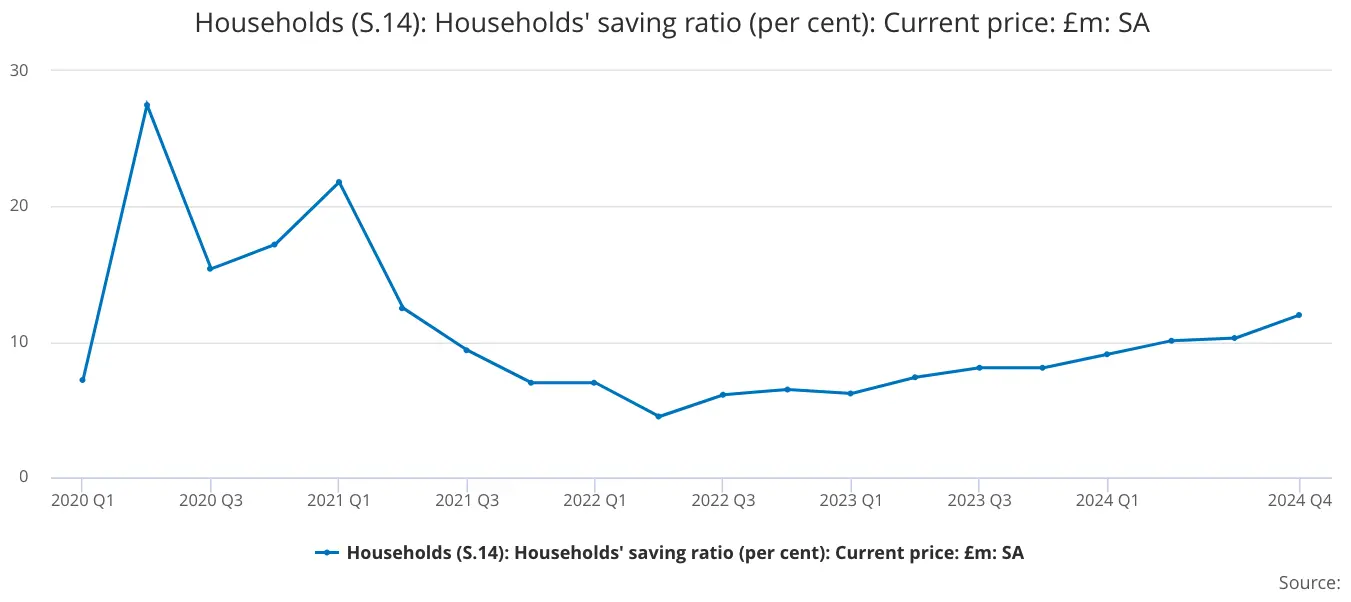

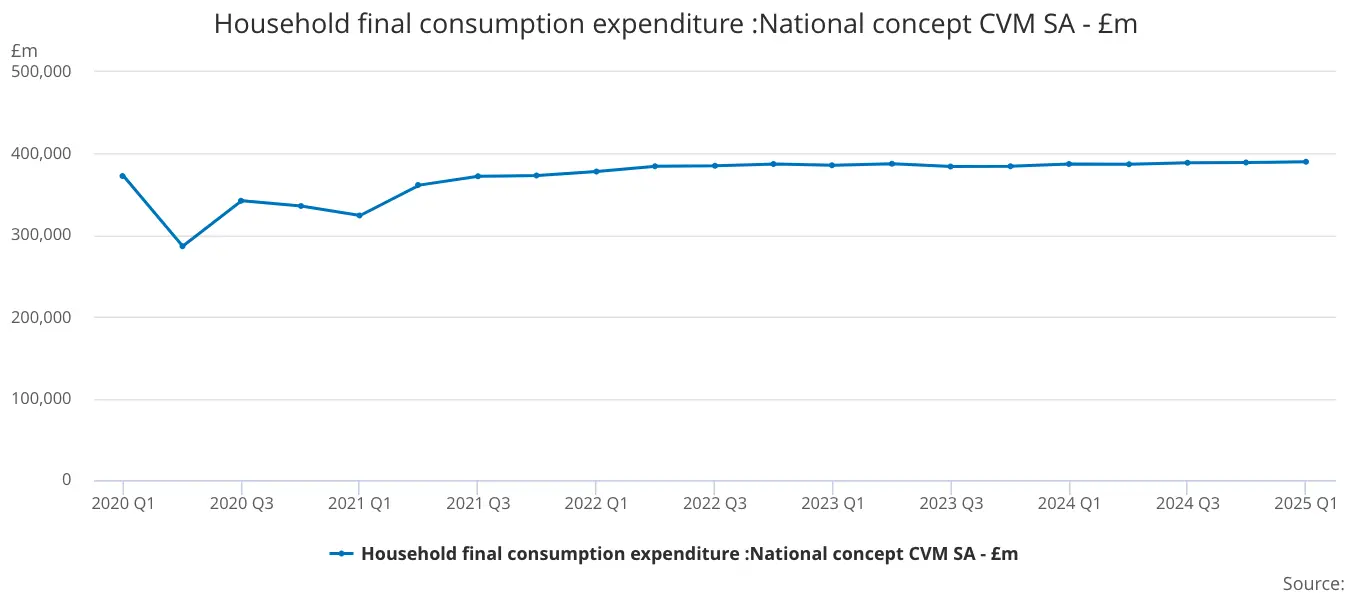

Has this extra purchasing power been spent? The reality is, even though people are earning more than before, they’re still being quite cautious. Government data shows that UK households have been aggressively saving since Q3 2022, with the savings rate rising from 6.1% to 12% in Q4 2024. Meanwhile, household spending barely changed during the same period. Meaning—most of the extra money is being saved, and spending patterns haven’t really changed.

These intertwined employment, wage, and consumption trends together form the complex current landscape of the UK economy.

References

Romei, Valentina, and Delphine Strauss. “Why Is UK Wage Growth so Strong?” Financial Times, 21 Mar. 2025.

Thwaites, Greg, et al. “Chilly Jobs, Warm Wages • Resolution Foundation.” Resolution Foundation, 21 Jan. 2025.

GOV.UK

- The National Minimum Wage in 2025, A report by the Low Pay Commission

ONS

- Employee earnings in the UK: 2024

- Vacancies and jobs in the UK: May 2025

- Average weekly earnings in Great Britain: May 2025

- Earnings and employment from Pay As You Earn Real Time Information, UK: May 2025

- Households (S.14): Households’ saving ratio (per cent): Current price: £m: SA

- Household final consumption expenditure : National concept CVM SA - Em